- 年金现值

年金现值

基本简介

年金(Annuity)是指一定期间内每期等额收付的款项。[2][3][4]因此,可以说年金是复利的产物,是复利的一种特殊形式(等额收付)

普通年金(Ordinary Annuity)是指每期期末收付款项的年金[2][3][5],例如采用直线法计提的单项固定资产的折旧(折旧总额会随着固定资产数量的变化而变化,不是年金,但就单项固定资产而言,其使用期内按直线法计提的折旧额是一定的)、一定期间的租金(租金不变期间)、每年员工的社会保险金(按月计算,每年7月1日到次年6月30日不变)、一定期间的贷款利息(即银行存贷款利率不变且存贷金额不变期间,如贷款金额在银行贷款利率不变期间有变化可以视为多笔年金)等。

先付年金(Annuity Due)是指每期期初收付款项的年金[6][7][8],例如先付钱后用餐的餐厅,每一道菜(包括米饭、面、饺子和馄饨等)分别出来之后都是先付年金。

递延年金(Deferred Annuity)是指在预备计算时尚未发生收付,但未来一定会发生若干期等额收付的年金[9][10][11],一般是在金融理财和社保回馈方面会产生递延年金。递延年金在做投资或其他资本预算时具有相当可观的作用。

永续年金(Perpetual Annuity)即无限期连续收付款的年金[12][13][14],最典型的就是诺贝尔奖金。 年金现值(3)

年金现值(3)

计算

普通年金现值

年金现值(3)普通年金现值是以计算期期末为基准,在给定投资报酬率下按照货币时间价值计算出的未来一段期间内每年或每月收取或给付的年金现金流的折现值之和。类似普通年金终值,计算普通年金现值时,同样要考虑到现金流是期初年金还是期末年金。

年金现值(3)普通年金现值是以计算期期末为基准,在给定投资报酬率下按照货币时间价值计算出的未来一段期间内每年或每月收取或给付的年金现金流的折现值之和。类似普通年金终值,计算普通年金现值时,同样要考虑到现金流是期初年金还是期末年金。

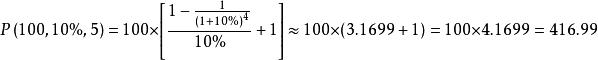

例如:某公司租用某设备,每年年末需要支付租金100元,年利率为10%,问5年内应支付的租金总额的现值是多少?

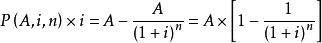

公式推导如下:

![]() 年金现值

年金现值

两边同时乘以![]() 得

得

两式作差得

最后两边同时除以i得到公式。

如果年金的期数n很多,用上述方法计算现值显然相当繁琐。由于每年支付额相等,折算现值的系数又是有规律的,所以,可找出简便的计算方法。

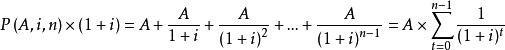

设每年的收付金额为A,利率为i,期数为n,则按复利计算的年金现值P为:

[15][16]。

[15][16]。

式中, 称为“年金现值系数”,记作(P/A,i,n),可查普通年金现值系数表。

称为“年金现值系数”,记作(P/A,i,n),可查普通年金现值系数表。

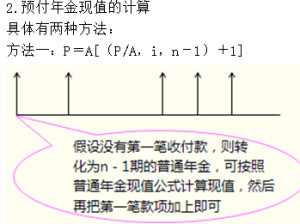

先付年金现值

先付年金现值:是其最后一期期末时的本利和,相当于各期期初等额收付款项的复利现值之和。

n期先付年金与n期普通年金的收付款次数相同,但由于付款时间不同,n期先付年金现值比n期普通年金的现值多计算一期利息。因此在n期普通年金现值的基础上乘以(1+i)而将分母加1就得出n期先付年金的现值了,公式为:

记作P(A,i,n)=A·[(P/A,i,n-1)+1]

则如果上例为每年初计息的话,经过5年,逐年的现值为年金现值,计算为:

递延年金现值

递延年金终值,它的计算完全可以利用普通年金终值公式来计算(因为递延期内没有年金)

永续年金现值

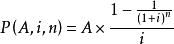

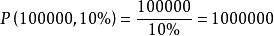

永续年金因为是无限期收付的,所以其计算公式反而简单,是 [13][17]

[13][17]

也就是说,如果这笔十万美元投资是一笔专项基金的话,其永续现值为 (美元)

(美元)

系数表

1%~5%

| 利率——期间 | 1% | 2% | 3% | 4% | 5% |

|---|---|---|---|---|---|

| 1 | 0.9901 | 0.9804 | 0.9709 | 0.9615 | 0.9524 |

| 2 | 1.9704 | 1.9416 | 1.9135 | 1.8861 | 1.8594 |

| 3 | 2.9410 | 2.8839 | 2.8286 | 2.7751 | 2.7232 |

| 4 | 3.9020 | 3.8077 | 3.7171 | 3.6299 | 3.5460 |

| 5 | 4.8534 | 4.7135 | 4.5797 | 4.4518 | 4.3295 |

| 6 | 5.7955 | 5.6014 | 5.4172 | 5.2421 | 5.0757 |

| 7 | 6.7282 | 6.4720 | 6.2303 | 6.0021 | 5.7864 |

| 8 | 7.6517 | 7.3255 | 7.0197 | 6.7327 | 6.4632 |

| 9 | 8.5660 | 8.1622 | 7.7861 | 7.4353 | 7.1078 |

| 10 | 9.4713 | 8.9826 | 8.5302 | 8.1109 | 7.7217 |

| 11 | 10.3676 | 9.7868 | 9.2526 | 8.7605 | 8.3064 |

| 12 | 11.2551 | 10.5753 | 9.9540 | 9.3851 | 8.8633 |

| 13 | 12.1337 | 11.3484 | 10.6350 | 9.9856 | 9.3936 |

| 14 | 13.0037 | 12.1062 | 11.2961 | 10.5631 | 9.8986 |

| 15 | 13.8651 | 12.8493 | 11.9379 | 11.1184 | 10.3797 |

| 16 | 14.7179 | 13.5777 | 12.5611 | 11.6523 | 10.8378 |

| 17 | 15.5623 | 14.2919 | 13.1661 | 12.1657 | 11.2740 |

| 18 | 16.3983 | 14.9920 | 13.7535 | 12.6593 | 11.6896 |

| 19 | 17.2260 | 15.6785 | 14.3238 | 13.1340 | 12.0853 |

| 20 | 18.0456 | 16.3514 | 14.8775 | 13.5903 | 12.4622 |

| 21 | 18.8570 | 17.0112 | 15.4150 | 14.0292 | 12.8212 |

| 22 | 19.6604 | 17.6580 | 15.9369 | 14.4511 | 13.1630 |

| 23 | 20.4558 | 18.2922 | 16.4436 | 14.8568 | 13.4886 |

| 24 | 21.2434 | 18.9139 | 16.9355 | 15.2470 | 13.7986 |

| 25 | 22.0232 | 19.5235 | 17.4131 | 15.6221 | 14.0939 |

| 26 | 22.7952 | 20.1210 | 17.8768 | 15.9828 | 14.3752 |

| 27 | 23.5596 | 20.7069 | 18.3270 | 16.3296 | 14.6430 |

| 28 | 24.3164 | 21.2813 | 18.7641 | 16.6631 | 14.8981 |

| 29 | 25.0658 | 21.8444 | 19.1885 | 16.9837 | 15.1411 |

| 30 | 25.8077 | 22.3965 | 19.6004 | 17.2920 | 15.3725 |

| 31 | 26.5423 | 22.9377 | 20.0004 | 17.5885 | 15.5928 |

| 32 | 27.2696 | 23.4683 | 20.3888 | 17.8736 | 15.8027 |

| 33 | 27.9897 | 23.9886 | 20.7658 | 18.1476 | 16.0025 |

| 34 | 28.7027 | 24.4986 | 21.1318 | 18.4112 | 16.1929 |

| 35 | 29.4086 | 24.9986 | 21.4872 | 18.6646 | 16.3742 |

| 36 | 30.1076 | 25.4888 | 21.8323 | 18.9083 | 16.5469 |

| 37 | 30.7995 | 25.9695 | 22.1672 | 19.1426 | 16.7113 |

| 38 | 31.4847 | 26.4406 | 22.4925 | 19.3679 | 16.8679 |

| 39 | 32.1630 | 26.9026 | 22.8082 | 19.5845 | 17.0170 |

| 40 | 32.8347 | 27.3555 | 23.1148 | 19.7928 | 17.1591 |

| 41 | 33.4997 | 27.7995 | 23.4124 | 19.9931 | 17.2944 |

| 42 | 34.1581 | 28.2348 | 23.7014 | 20.1856 | 17.4232 |

| 43 | 34.8100 | 28.6616 | 23.9819 | 20.3708 | 17.5459 |

| 44 | 35.4555 | 29.0800 | 24.2543 | 20.5488 | 17.6628 |

| 45 | 36.0945 | 29.4902 | 24.5187 | 20.7200 | 17.7741 |

| 46 | 36.7272 | 29.8923 | 24.7754 | 20.8847 | 17.8801 |

| 47 | 37.3537 | 30.2866 | 25.0247 | 21.0429 | 17.9810 |

| 48 | 37.9740 | 30.6731 | 25.2667 | 21.1951 | 18.0772 |

| 49 | 38.5881 | 31.0521 | 25.5017 | 21.3414 | 18.1687 |

| 50 | 39.1961 | 31.4236 | 25.7298 | 21.4822 | 18.2559 |

[18][19][20]

6%~10%

| 利率——期数 | 6% | 7% | 8% | 9% | 10% |

|---|---|---|---|---|---|

| 1 | 0.9434 | 0.9346 | 0.9259 | 0.9174 | 0.9091 |

| 2 | 1.8334 | 1.8080 | 1.7833 | 1.7591 | 1.7355 |

| 3 | 2.6730 | 2.6243 | 2.5771 | 2.5313 | 2.4869 |

| 4 | 3.4651 | 3.3872 | 3.3121 | 3.2397 | 3.1699 |

| 5 | 4.2124 | 4.1002 | 3.9927 | 3.8897 | 3.7908 |

| 6 | 4.9173 | 4.7665 | 4.6228 | 4.4859 | 4.3553 |

| 7 | 5.5824 | 5.3893 | 5.2064 | 5.0330 | 4.8684 |

| 8 | 6.2098 | 5.9713 | 5.7466 | 5.5348 | 5.3349 |

| 9 | 6.8017 | 6.5152 | 6.2469 | 5.9952 | 5.7590 |

| 10 | 7.3601 | 7.0236 | 6.7101 | 6.4176 | 6.1446 |

| 11 | 7.8869 | 7.4987 | 7.1390 | 6.8052 | 6.4951 |

| 12 | 8.3838 | 7.9427 | 7.5361 | 7.1607 | 6.8137 |

| 13 | 8.8527 | 8.3577 | 7.9038 | 7.4869 | 7.1034 |

| 14 | 9.2950 | 8.7455 | 8.2442 | 7.7862 | 7.3667 |

| 15 | 9.7122 | 9.1079 | 8.5595 | 8.0607 | 7.6061 |

| 16 | 10.1059 | 9.4466 | 8.8514 | 8.3126 | 7.8237 |

| 17 | 10.4773 | 9.7632 | 9.1216 | 8.5436 | 8.0216 |

| 18 | 10.8276 | 10.0591 | 9.3719 | 8.7556 | 8.2014 |

| 19 | 11.1581 | 10.3356 | 9.6036 | 8.9501 | 8.3649 |

| 20 | 11.4699 | 10.5940 | 9.8181 | 9.1285 | 8.5136 |

| 21 | 11.7641 | 10.8355 | 10.0168 | 9.2922 | 8.6487 |

| 22 | 12.0416 | 11.0612 | 10.2007 | 9.4424 | 8.7715 |

| 23 | 12.3034 | 11.2722 | 10.3711 | 9.5802 | 8.8832 |

| 24 | 12.5504 | 11.4693 | 10.5288 | 9.7066 | 8.9847 |

| 25 | 12.7834 | 11.6536 | 10.6748 | 9.8226 | 9.0770 |

| 26 | 13.0032 | 11.8258 | 10.8100 | 9.9290 | 9.1609 |

| 27 | 13.2105 | 11.9867 | 10.9352 | 10.0266 | 9.2372 |

| 28 | 13.4062 | 12.1371 | 11.0511 | 10.1161 | 9.3066 |

| 29 | 13.5907 | 12.2777 | 11.1584 | 10.1983 | 9.3696 |

| 30 | 13.7648 | 12.4090 | 11.2578 | 10.2737 | 9.4269 |

| 31 | 13.9291 | 12.5318 | 11.3498 | 10.3428 | 9.4790 |

| 32 | 14.0840 | 12.6466 | 11.4350 | 10.4062 | 9.5264 |

| 33 | 14.2302 | 12.7538 | 11.5139 | 10.4644 | 9.5694 |

| 34 | 14.3681 | 12.8540 | 11.5869 | 10.5178 | 9.6086 |

| 35 | 14.4982 | 12.9477 | 11.6546 | 10.5668 | 9.6442 |

| 36 | 14.6210 | 13.0352 | 11.7172 | 10.6118 | 9.6765 |

| 37 | 14.7368 | 13.1170 | 11.7752 | 10.6530 | 9.7059 |

| 38 | 14.8460 | 13.1935 | 11.8289 | 10.6908 | 9.7327 |

| 39 | 14.9491 | 13.2649 | 11.8786 | 10.7255 | 9.7570 |

| 40 | 15.0463 | 13.3317 | 11.9246 | 10.7574 | 9.7791 |

| 41 | 15.1380 | 13.3941 | 11.9672 | 10.7866 | 9.7991 |

| 42 | 15.2245 | 13.4524 | 12.0067 | 10.8133 | 9.8174 |

| 43 | 15.3062 | 13.5070 | 12.0432 | 10.8380 | 9.8340 |

| 44 | 15.3832 | 13.5579 | 12.0771 | 10.8605 | 9.8491 |

| 45 | 15.4558 | 13.6055 | 12.1084 | 10.8812 | 9.8628 |

| 46 | 15.5244 | 13.6500 | 12.1374 | 10.9002 | 9.8753 |

| 47 | 15.5890 | 13.6916 | 12.1643 | 10.9176 | 9.8866 |

| 48 | 15.6500 | 13.7305 | 12.1892 | 10.9336 | 9.8969 |

| 49 | 15.7076 | 13.7668 | 12.2122 | 10.9482 | 9.9063 |

| 50 | 15.7619 | 13.8007 | 12.2335 | 10.9617 | 9.9148 |

[20][21][22]

11%~15%

| 利率——期数 | 11% | 12% | 13% | 14% | 15% |

|---|---|---|---|---|---|

| 1 | 0.9009 | 0.8929 | 0.8850 | 0.8772 | 0.8696 |

| 2 | 1.7125 | 1.6901 | 1.6681 | 1.6466 | 1.6257 |

| 3 | 2.4437 | 2.4018 | 2.3612 | 2.3216 | 2.2832 |

| 4 | 3.1024 | 3.0373 | 2.9745 | 2.9137 | 2.8550 |

| 5 | 3.6958 | 3.6048 | 3.5172 | 3.4331 | 3.3522 |

| 6 | 4.2305 | 4.1114 | 3.9975 | 3.8887 | 3.7845 |

| 7 | 4.7122 | 4.5638 | 4.4226 | 4.2883 | 4.1604 |

| 8 | 5.1461 | 4.9676 | 4.7988 | 4.6389 | 4.4873 |

| 9 | 5.5370 | 5.3282 | 5.1317 | 4.9464 | 4.7716 |

| 10 | 5.8892 | 5.6502 | 5.4262 | 5.2161 | 5.0188 |

| 11 | 6.2065 | 5.9377 | 5.6869 | 5.4527 | 5.2337 |

| 12 | 6.4924 | 6.1944 | 5.9176 | 5.6603 | 5.4206 |

| 13 | 6.7499 | 6.4235 | 6.1218 | 5.8424 | 5.5831 |

| 14 | 6.9819 | 6.6282 | 6.3025 | 6.0021 | 5.7245 |

| 15 | 7.1909 | 6.8109 | 6.4624 | 6.1422 | 5.8474 |

| 16 | 7.3792 | 6.9740 | 6.6039 | 6.2651 | 5.9542 |

| 17 | 7.5488 | 7.1196 | 6.7291 | 6.3729 | 6.0472 |

| 18 | 7.7016 | 7.2497 | 6.8399 | 6.4674 | 6.1280 |

| 19 | 7.8393 | 7.3657 | 6.9380 | 6.5504 | 6.1982 |

| 20 | 7.9633 | 7.4694 | 7.0248 | 6.6231 | 6.2593 |

| 21 | 8.0751 | 7.5620 | 7.1016 | 6.6870 | 6.3125 |

| 22 | 8.1757 | 7.6446 | 7.1695 | 6.7429 | 6.3587 |

| 23 | 8.2664 | 7.7184 | 7.2297 | 6.7921 | 6.3988 |

| 24 | 8.3481 | 7.7843 | 7.2829 | 6.8351 | 6.4338 |

| 25 | 8.4217 | 7.8431 | 7.3300 | 6.8729 | 6.4641 |

| 26 | 8.4881 | 7.8957 | 7.3717 | 6.9061 | 6.4906 |

| 27 | 8.5478 | 7.9426 | 7.4086 | 6.9352 | 6.5135 |

| 28 | 8.6016 | 7.9844 | 7.4412 | 6.9607 | 6.5335 |

| 29 | 8.6501 | 8.0218 | 7.4701 | 6.9830 | 6.5509 |

| 30 | 8.6938 | 8.0552 | 7.4957 | 7.0027 | 6.5660 |

| 31 | 8.7331 | 8.0850 | 7.5183 | 7.0199 | 6.5791 |

| 32 | 8.7686 | 8.1116 | 7.5382 | 7.0350 | 6.5905 |

| 33 | 8.8005 | 8.1354 | 7.5560 | 7.0482 | 6.6005 |

| 34 | 8.8293 | 8.1566 | 7.5717 | 7.0599 | 6.6091 |

| 35 | 8.8552 | 8.1755 | 7.5856 | 7.0700 | 6.6166 |

| 36 | 8.8786 | 8.1924 | 7.5979 | 7.0790 | 6.6231 |

| 37 | 8.8996 | 8.2075 | 7.6087 | 7.0868 | 6.6288 |

| 38 | 8.9186 | 8.2210 | 7.6183 | 7.0937 | 6.6338 |

| 39 | 8.9357 | 8.2330 | 7.6268 | 7.0997 | 6.6380 |

| 40 | 8.9511 | 8.2438 | 7.6344 | 7.1050 | 6.6418 |

| 41 | 8.9649 | 8.2534 | 7.6410 | 7.1097 | 6.6450 |

| 42 | 8.9774 | 8.2619 | 7.6469 | 7.1138 | 6.6478 |

| 43 | 8.9886 | 8.2696 | 7.6522 | 7.1173 | 6.6503 |

| 44 | 8.9988 | 8.2764 | 7.6568 | 7.1205 | 6.6524 |

| 45 | 9.0079 | 8.2825 | 7.6609 | 7.1232 | 6.6543 |

| 46 | 9.0161 | 8.2880 | 7.6645 | 7.1256 | 6.6559 |

| 47 | 9.0235 | 8.2928 | 7.6677 | 7.1277 | 6.6573 |

| 48 | 9.0302 | 8.2972 | 7.6705 | 7.1296 | 6.6585 |

| 49 | 9.0362 | 8.3010 | 7.6730 | 7.1312 | 6.6596 |

| 50 | 9.0417 | 8.3045 | 7.6752 | 7.1327 | 6.6605 |

[23][24][25]

16%~20%

| 利率——期数 | 16% | 17% | 18% | 19% | 20% |

|---|---|---|---|---|---|

| 1 | 0.8621 | 0.8547 | 0.8475 | 0.8403 | 0.8333 |

| 2 | 1.6052 | 1.5852 | 1.5656 | 1.5465 | 1.5278 |

| 3 | 2.2459 | 2.2096 | 2.1743 | 2.1399 | 2.1065 |

| 4 | 2.7982 | 2.7432 | 2.6901 | 2.6386 | 2.5887 |

| 5 | 3.2743 | 3.1993 | 3.1272 | 3.0576 | 2.9906 |

| 6 | 3.6847 | 3.5892 | 3.4976 | 3.4098 | 3.3255 |

| 7 | 4.0386 | 3.9224 | 3.8115 | 3.7057 | 3.6046 |

| 8 | 4.3436 | 4.2072 | 4.0776 | 3.9544 | 3.8372 |

| 9 | 4.6065 | 4.4506 | 4.3030 | 4.1633 | 4.0310 |

| 10 | 4.8332 | 4.6586 | 4.4941 | 4.3389 | 4.1925 |

| 11 | 5.0286 | 4.8364 | 4.6560 | 4.4865 | 4.3271 |

| 12 | 5.1971 | 4.9884 | 4.7932 | 4.6105 | 4.4392 |

| 13 | 5.3423 | 5.1183 | 4.9095 | 4.7147 | 4.5327 |

| 14 | 5.4675 | 5.2293 | 5.0081 | 4.8023 | 4.6106 |

| 15 | 5.5755 | 5.3242 | 5.0916 | 4.8759 | 4.6755 |

| 16 | 5.6685 | 5.4053 | 5.1624 | 4.9377 | 4.7296 |

| 17 | 5.7487 | 5.4746 | 5.2223 | 4.9897 | 4.7746 |

| 18 | 5.8178 | 5.5339 | 5.2732 | 5.0333 | 4.8122 |

| 19 | 5.8775 | 5.5845 | 5.3162 | 5.0700 | 4.8435 |

| 20 | 5.9288 | 5.6278 | 5.3527 | 5.1009 | 4.8696 |

| 21 | 5.9731 | 5.6647 | 5.3837 | 5.1268 | 4.8913 |

| 22 | 6.0113 | 5.6964 | 5.4099 | 5.1486 | 4.9094 |

| 23 | 6.0442 | 5.7234 | 5.4321 | 5.1668 | 4.9245 |

| 24 | 6.0726 | 5.7465 | 5.4509 | 5.1822 | 4.9371 |

| 25 | 6.0971 | 5.7662 | 5.4669 | 5.1951 | 4.9475 |

| 26 | 6.1182 | 5.7831 | 5.4804 | 5.2060 | 4.9563 |

| 27 | 6.1364 | 5.7975 | 5.4919 | 5.2151 | 4.9636 |

| 28 | 6.1520 | 5.8099 | 5.5016 | 5.2228 | 4.9697 |

| 29 | 6.1656 | 5.8204 | 5.5098 | 5.2292 | 4.9747 |

| 30 | 6.1772 | 5.8294 | 5.5168 | 5.2347 | 4.9789 |

| 31 | 6.1872 | 5.8371 | 5.5227 | 5.2392 | 4.9824 |

| 32 | 6.1958 | 5.8437 | 5.5277 | 5.2430 | 4.9854 |

| 33 | 6.2034 | 5.8493 | 5.5320 | 5.2462 | 4.9878 |

| 34 | 6.2098 | 5.8541 | 5.5356 | 5.2489 | 4.9898 |

| 35 | 6.2153 | 5.8582 | 5.5386 | 5.2512 | 4.9915 |

| 36 | 6.2201 | 5.8617 | 5.5412 | 5.2531 | 4.9929 |

| 37 | 6.2242 | 5.8647 | 5.5434 | 5.2547 | 4.9941 |

| 38 | 6.2278 | 5.8673 | 5.5452 | 5.2561 | 4.9951 |

| 39 | 6.2309 | 5.8695 | 5.5468 | 5.2572 | 4.9959 |

| 40 | 6.2335 | 5.8713 | 5.5482 | 5.2582 | 4.9966 |

| 41 | 6.2358 | 5.8729 | 5.5493 | 5.2590 | 4.9972 |

| 42 | 6.2377 | 5.8743 | 5.5502 | 5.2596 | 4.9976 |

| 43 | 6.2394 | 5.8755 | 5.5510 | 5.2602 | 4.9980 |

| 44 | 6.2409 | 5.8765 | 5.5517 | 5.2607 | 4.9984 |

| 45 | 6.2421 | 5.8773 | 5.5523 | 5.2611 | 4.9986 |

| 46 | 6.2432 | 5.8781 | 5.5528 | 5.2614 | 4.9989 |

| 47 | 6.2442 | 5.8787 | 5.5532 | 5.2617 | 4.9991 |

| 48 | 6.2450 | 5.8792 | 5.5536 | 5.2619 | 4.9992 |

| 49 | 6.2457 | 5.8797 | 5.5539 | 5.2621 | 4.9993 |

| 50 | 6.2463 | 5.8801 | 5.5541 | 5.2623 | 4.9995 |

[25][26][27]

21%~25%

| 利率——期数 | 21% | 22% | 23% | 24% | 25% |

|---|---|---|---|---|---|

| 1 | 0.8264 | 0.8197 | 0.8130 | 0.8065 | 0.8000 |

| 2 | 1.5095 | 1.4915 | 1.4740 | 1.4568 | 1.4400 |

| 3 | 2.0739 | 2.0422 | 2.0114 | 1.9813 | 1.9520 |

| 4 | 2.5404 | 2.4936 | 2.4483 | 2.4043 | 2.3616 |

| 5 | 2.9260 | 2.8636 | 2.8035 | 2.7454 | 2.6893 |

| 6 | 3.2446 | 3.1669 | 3.0923 | 3.0205 | 2.9514 |

| 7 | 3.5079 | 3.4155 | 3.3270 | 3.2423 | 3.1611 |

| 8 | 3.7256 | 3.6193 | 3.5179 | 3.4212 | 3.3289 |

| 9 | 3.9054 | 3.7863 | 3.6731 | 3.5655 | 3.4631 |

| 10 | 4.0541 | 3.9232 | 3.7993 | 3.6819 | 3.5705 |

| 11 | 4.1769 | 4.0354 | 3.9018 | 3.7757 | 3.6564 |

| 12 | 4.2784 | 4.1274 | 3.9852 | 3.8514 | 3.7251 |

| 13 | 4.3624 | 4.2028 | 4.0530 | 3.9124 | 3.7801 |

| 14 | 4.4317 | 4.2646 | 4.1082 | 3.9616 | 3.8241 |

| 15 | 4.4890 | 4.3152 | 4.1530 | 4.0013 | 3.8593 |

| 16 | 4.5364 | 4.3567 | 4.1894 | 4.0333 | 3.8874 |

| 17 | 4.5755 | 4.3908 | 4.2190 | 4.0591 | 3.9099 |

| 18 | 4.6079 | 4.4187 | 4.2431 | 4.0799 | 3.9279 |

| 19 | 4.6346 | 4.4415 | 4.2627 | 4.0967 | 3.9424 |

| 20 | 4.6566 | 4.4603 | 4.2786 | 4.1103 | 3.9539 |

| 21 | 4.6750 | 4.4756 | 4.2916 | 4.1212 | 3.9631 |

| 22 | 4.6900 | 4.4882 | 4.3021 | 4.1300 | 3.9705 |

| 23 | 4.7025 | 4.4985 | 4.3106 | 4.1371 | 3.9764 |

| 24 | 4.7128 | 4.5070 | 4.3176 | 4.1428 | 3.9811 |

| 25 | 4.7213 | 4.5139 | 4.3232 | 4.1474 | 3.9849 |

| 26 | 4.7284 | 4.5196 | 4.3278 | 4.1511 | 3.9879 |

| 27 | 4.7342 | 4.5243 | 4.3316 | 4.1542 | 3.9903 |

| 28 | 4.7390 | 4.5281 | 4.3346 | 4.1566 | 3.9923 |

| 29 | 4.7430 | 4.5312 | 4.3371 | 4.1585 | 3.9938 |

| 30 | 4.7463 | 4.5338 | 4.3391 | 4.1601 | 3.9950 |

| 31 | 4.7490 | 4.5359 | 4.3407 | 4.1614 | 3.9960 |

| 32 | 4.7512 | 4.5376 | 4.3421 | 4.1624 | 3.9968 |

| 33 | 4.7531 | 4.5390 | 4.3431 | 4.1632 | 3.9975 |

| 34 | 4.7546 | 4.5402 | 4.3440 | 4.1639 | 3.9980 |

| 35 | 4.7559 | 4.5411 | 4.3447 | 4.1644 | 3.9984 |

| 36 | 4.7569 | 4.5419 | 4.3453 | 4.1649 | 3.9987 |

| 37 | 4.7578 | 4.5426 | 4.3458 | 4.1652 | 3.9990 |

| 38 | 4.7585 | 4.5431 | 4.3462 | 4.1655 | 3.9992 |

| 39 | 4.7590 | 4.5435 | 4.3465 | 4.1657 | 3.9993 |

| 40 | 4.7596 | 4.5439 | 4.3467 | 4.1659 | 3.9995 |

| 41 | 4.7600 | 4.5441 | 4.3469 | 4.1661 | 3.9996 |

| 42 | 4.7603 | 4.5444 | 4.3471 | 4.1662 | 3.9997 |

| 43 | 4.7606 | 4.5446 | 4.3472 | 4.1663 | 3.9997 |

| 44 | 4.7608 | 4.5447 | 4.3473 | 4.1663 | 3.9998 |

| 45 | 4.7610 | 4.5448 | 4.3474 | 4.1664 | 3.9998 |

| 46 | 4.7612 | 4.5450 | 4.3475 | 4.1665 | 3.9999 |

| 47 | 4.7613 | 4.5451 | 4.3476 | 4.1665 | 3.9999 |

| 48 | 4.7614 | 4.5451 | 4.3476 | 4.1665 | 3.9999 |

| 49 | 4.7615 | 4.5452 | 4.3477 | 4.1666 | 3.9999 |

| 50 | 4.7616 | 4.5452 | 4.3477 | 4.1666 | 3.9999 |

[28][29][30]

26%~30%

| 利率——期数 | 26% | 27% | 28% | 29% | 30% |

|---|---|---|---|---|---|

| 1 | 0.7937 | 0.7874 | 0.7813 | 0.7752 | 0.7692 |

| 2 | 1.4235 | 1.4074 | 1.3916 | 1.3761 | 1.3609 |

| 3 | 1.9234 | 1.8956 | 1.8684 | 1.8420 | 1.8161 |

| 4 | 2.3202 | 2.2800 | 2.2410 | 2.2031 | 2.1662 |

| 5 | 2.6351 | 2.5827 | 2.5320 | 2.4830 | 2.4356 |

| 6 | 2.8850 | 2.8210 | 2.7594 | 2.7000 | 2.6427 |

| 7 | 3.0833 | 3.0087 | 2.9370 | 2.8682 | 2.8021 |

| 8 | 3.2407 | 3.1564 | 3.0758 | 2.9986 | 2.9247 |

| 9 | 3.3657 | 3.2728 | 3.1842 | 3.0997 | 3.0190 |

| 10 | 3.4648 | 3.3644 | 3.2689 | 3.1780 | 3.0915 |

| 11 | 3.5435 | 3.4365 | 3.3351 | 3.2388 | 3.1473 |

| 12 | 3.6059 | 3.4933 | 3.3868 | 3.2859 | 3.1903 |

| 13 | 3.6555 | 3.5381 | 3.4272 | 3.3224 | 3.2233 |

| 14 | 3.6949 | 3.5733 | 3.4587 | 3.3507 | 3.2487 |

| 15 | 3.7261 | 3.6010 | 3.4834 | 3.3726 | 3.2682 |

| 16 | 3.7509 | 3.6228 | 3.5026 | 3.3896 | 3.2832 |

| 17 | 3.7705 | 3.6400 | 3.5177 | 3.4028 | 3.2948 |

| 18 | 3.7861 | 3.6536 | 3.5294 | 3.4130 | 3.3037 |

| 19 | 3.7985 | 3.6642 | 3.5386 | 3.4210 | 3.3105 |

| 20 | 3.8083 | 3.6726 | 3.5458 | 3.4271 | 3.3158 |

| 21 | 3.8161 | 3.6792 | 3.5514 | 3.4318 | 3.3198 |

| 22 | 3.8223 | 3.6844 | 3.5558 | 3.4356 | 3.3230 |

| 23 | 3.8273 | 3.6885 | 3.5592 | 3.4384 | 3.3254 |

| 24 | 3.8312 | 3.6918 | 3.5619 | 3.4406 | 3.3272 |

| 25 | 3.8342 | 3.6943 | 3.5640 | 3.4423 | 3.3286 |

| 26 | 3.8367 | 3.6963 | 3.5656 | 3.4437 | 3.3297 |

| 27 | 3.8387 | 3.6979 | 3.5669 | 3.4447 | 3.3306 |

| 28 | 3.8402 | 3.6991 | 3.5679 | 3.4455 | 3.3312 |

| 29 | 3.8414 | 3.7001 | 3.5687 | 3.4461 | 3.3317 |

| 30 | 3.8424 | 3.7009 | 3.5693 | 3.4466 | 3.3321 |

| 31 | 3.8432 | 3.7015 | 3.5697 | 3.4470 | 3.3324 |

| 32 | 3.8438 | 3.7019 | 3.5701 | 3.4473 | 3.3326 |

| 33 | 3.8443 | 3.7023 | 3.5704 | 3.4475 | 3.3328 |

| 34 | 3.8447 | 3.7026 | 3.5706 | 3.4477 | 3.3329 |

| 35 | 3.8450 | 3.7028 | 3.5708 | 3.4478 | 3.3330 |

| 36 | 3.8452 | 3.7030 | 3.5709 | 3.4479 | 3.3331 |

| 37 | 3.8454 | 3.7032 | 3.5710 | 3.4480 | 3.3331 |

| 38 | 3.8456 | 3.7033 | 3.5711 | 3.4481 | 3.3332 |

| 39 | 3.8457 | 3.7034 | 3.5712 | 3.4481 | 3.3332 |

| 40 | 3.8458 | 3.7034 | 3.5712 | 3.4481 | 3.3332 |

| 41 | 3.8459 | 3.7035 | 3.5713 | 3.4482 | 3.3333 |

| 42 | 3.8459 | 3.7035 | 3.5713 | 3.4482 | 3.3333 |

| 43 | 3.8460 | 3.7036 | 3.5713 | 3.4482 | 3.3333 |

| 44 | 3.8460 | 3.7036 | 3.5714 | 3.4482 | 3.3333 |

| 45 | 3.8460 | 3.7036 | 3.5714 | 3.4482 | 3.3333 |

| 46 | 3.8461 | 3.7036 | 3.5714 | 3.4482 | 3.3333 |

| 47 | 3.8461 | 3.7037 | 3.5714 | 3.4483 | 3.3333 |

| 48 | 3.8461 | 3.7037 | 3.5714 | 3.4483 | 3.3333 |

| 49 | 3.8461 | 3.7037 | 3.5714 | 3.4483 | 3.3333 |

| 50 | 3.8461 | 3.7037 | 3.5714 | 3.4483 | 3.3333 |

[29][31][30]

31%~35%

| 利率——期数 | 31% | 32% | 33% | 34% | 35% |

|---|---|---|---|---|---|

| 1 | 0.7634 | 0.7576 | 0.7519 | 0.7463 | 0.7407 |

| 2 | 1.3461 | 1.3315 | 1.3172 | 1.3032 | 1.2894 |

| 3 | 1.7909 | 1.7663 | 1.7423 | 1.7188 | 1.6959 |

| 4 | 2.1305 | 2.0957 | 2.0618 | 2.0290 | 1.9969 |

| 5 | 2.3897 | 2.3452 | 2.3021 | 2.2604 | 2.2200 |

| 6 | 2.5875 | 2.5342 | 2.4828 | 2.4331 | 2.3852 |

| 7 | 2.7386 | 2.6775 | 2.6187 | 2.5620 | 2.5075 |

| 8 | 2.8539 | 2.7860 | 2.7208 | 2.6582 | 2.5982 |

| 9 | 2.9419 | 2.8681 | 2.7976 | 2.7300 | 2.6653 |

| 10 | 3.0091 | 2.9304 | 2.8553 | 2.7836 | 2.7150 |

| 11 | 3.0604 | 2.9776 | 2.8987 | 2.8236 | 2.7519 |

| 12 | 3.0995 | 3.0133 | 2.9313 | 2.8534 | 2.7792 |

| 13 | 3.1294 | 3.0404 | 2.9559 | 2.8757 | 2.7994 |

| 14 | 3.1522 | 3.0609 | 2.9744 | 2.8923 | 2.8144 |

| 15 | 3.1696 | 3.0764 | 2.9883 | 2.9047 | 2.8255 |

| 16 | 3.1829 | 3.0882 | 2.9987 | 2.9140 | 2.8337 |

| 17 | 3.1931 | 3.0971 | 3.0065 | 2.9209 | 2.8398 |

| 18 | 3.2008 | 3.1039 | 3.0124 | 2.9260 | 2.8443 |

| 19 | 3.2067 | 3.1090 | 3.0169 | 2.9299 | 2.8476 |

| 20 | 3.2112 | 3.1129 | 3.0202 | 2.9327 | 2.8501 |

| 21 | 3.2147 | 3.1158 | 3.0227 | 2.9349 | 2.8519 |

| 22 | 3.2173 | 3.1180 | 3.0246 | 2.9365 | 2.8533 |

| 23 | 3.2193 | 3.1197 | 3.0260 | 2.9377 | 2.8543 |

| 24 | 3.2209 | 3.1210 | 3.0271 | 2.9386 | 2.8550 |

| 25 | 3.2220 | 3.1220 | 3.0279 | 2.9392 | 2.8556 |

| 26 | 3.2229 | 3.1227 | 3.0285 | 2.9397 | 2.8560 |

| 27 | 3.2236 | 3.1233 | 3.0289 | 2.9401 | 2.8563 |

| 28 | 3.2241 | 3.1237 | 3.0293 | 2.9404 | 2.8565 |

| 29 | 3.2245 | 3.1240 | 3.0295 | 2.9406 | 2.8567 |

| 30 | 3.2248 | 3.1242 | 3.0297 | 2.9407 | 2.8568 |

| 31 | 3.2251 | 3.1244 | 3.0299 | 2.9408 | 2.8569 |

| 32 | 3.2252 | 3.1246 | 3.0300 | 2.9409 | 2.8569 |

| 33 | 3.2254 | 3.1247 | 3.0301 | 2.9410 | 2.8570 |

| 34 | 3.2255 | 3.1248 | 3.0301 | 2.9410 | 2.8570 |

| 35 | 3.2256 | 3.1248 | 3.0302 | 2.9411 | 2.8571 |

| 36 | 3.2256 | 3.1249 | 3.0302 | 2.9411 | 2.8571 |

| 37 | 3.2257 | 3.1249 | 3.0302 | 2.9411 | 2.8571 |

| 38 | 3.2257 | 3.1249 | 3.0302 | 2.9411 | 2.8571 |

| 39 | 3.2257 | 3.1249 | 3.0303 | 2.9411 | 2.8571 |

| 40 | 3.2257 | 3.1250 | 3.0303 | 2.9412 | 2.8571 |

| 41 | 3.2258 | 3.1250 | 3.0303 | 2.9412 | 2.8571 |

| 42 | 3.2258 | 3.1250 | 3.0303 | 2.9412 | 2.8571 |

| 43 | 3.2258 | 3.1250 | 3.0303 | 2.9412 | 2.8571 |

| 44 | 3.2258 | 3.1250 | 3.0303 | 2.9412 | 2.8571 |

| 45 | 3.2258 | 3.1250 | 3.0303 | 2.9412 | 2.8571 |

| 46 | 3.2258 | 3.1250 | 3.0303 | 2.9412 | 2.8571 |

| 47 | 3.2258 | 3.1250 | 3.0303 | 2.9412 | 2.8571 |

| 48 | 3.2258 | 3.1250 | 3.0303 | 2.9412 | 2.8571 |

| 49 | 3.2258 | 3.1250 | 3.0303 | 2.9412 | 2.8571 |

| 50 | 3.2258 | 3.1250 | 3.0303 | 2.9412 | 2.8571 |

[28][29]

36%~40%

| 利率——期数 | 36% | 37% | 38% | 39% | 40% |

|---|---|---|---|---|---|

| 1 | 0.7353 | 0.7299 | 0.7246 | 0.7194 | 0.7143 |

| 2 | 1.2760 | 1.2627 | 1.2497 | 1.2370 | 1.2245 |

| 3 | 1.6735 | 1.6516 | 1.6302 | 1.6093 | 1.5889 |

| 4 | 1.9658 | 1.9355 | 1.9060 | 1.8772 | 1.8492 |

| 5 | 2.1808 | 2.1427 | 2.1058 | 2.0699 | 2.0352 |

| 6 | 2.3388 | 2.2939 | 2.2506 | 2.2086 | 2.1680 |

| 7 | 2.4550 | 2.4043 | 2.3555 | 2.3083 | 2.2628 |

| 8 | 2.5404 | 2.4849 | 2.4315 | 2.3801 | 2.3306 |

| 9 | 2.6033 | 2.5437 | 2.4866 | 2.4317 | 2.3790 |

| 10 | 2.6495 | 2.5867 | 2.5265 | 2.4689 | 2.4136 |

| 11 | 2.6834 | 2.6180 | 2.5555 | 2.4956 | 2.4383 |

| 12 | 2.7084 | 2.6409 | 2.5764 | 2.5148 | 2.4559 |

| 13 | 2.7268 | 2.6576 | 2.5916 | 2.5286 | 2.4685 |

| 14 | 2.7403 | 2.6698 | 2.6026 | 2.5386 | 2.4775 |

| 15 | 2.7502 | 2.6787 | 2.6106 | 2.5457 | 2.4839 |

| 16 | 2.7575 | 2.6852 | 2.6164 | 2.5509 | 2.4885 |

| 17 | 2.7629 | 2.6899 | 2.6206 | 2.5546 | 2.4918 |

| 18 | 2.7668 | 2.6934 | 2.6236 | 2.5573 | 2.4941 |

| 19 | 2.7697 | 2.6959 | 2.6258 | 2.5592 | 2.4958 |

| 20 | 2.7718 | 2.6977 | 2.6274 | 2.5606 | 2.4970 |

| 21 | 2.7734 | 2.6991 | 2.6286 | 2.5616 | 2.4979 |

| 22 | 2.7746 | 2.7000 | 2.6294 | 2.5623 | 2.4985 |

| 23 | 2.7754 | 2.7008 | 2.6300 | 2.5628 | 2.4989 |

| 24 | 2.7760 | 2.7013 | 2.6304 | 2.5632 | 2.4992 |

| 25 | 2.7765 | 2.7017 | 2.6307 | 2.5634 | 2.4994 |

| 26 | 2.7768 | 2.7019 | 2.6310 | 2.5636 | 2.4996 |

| 27 | 2.7771 | 2.7022 | 2.6311 | 2.5637 | 2.4997 |

| 28 | 2.7773 | 2.7023 | 2.6313 | 2.5638 | 2.4998 |

| 29 | 2.7774 | 2.7024 | 2.6313 | 2.5639 | 2.4999 |

| 30 | 2.7775 | 2.7025 | 2.6314 | 2.5640 | 2.4999 |

| 31 | 2.7776 | 2.7025 | 2.6315 | 2.5640 | 2.4999 |

| 32 | 2.7776 | 2.7026 | 2.6315 | 2.5640 | 2.4999 |

| 33 | 2.7777 | 2.7026 | 2.6315 | 2.5641 | 2.5000 |

| 34 | 2.7777 | 2.7026 | 2.6315 | 2.5641 | 2.5000 |

| 35 | 2.7777 | 2.7027 | 2.6315 | 2.5641 | 2.5000 |

| 36 | 2.7777 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 37 | 2.7777 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 38 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 39 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 40 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 41 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 42 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 43 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 44 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 45 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 46 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 47 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 48 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 49 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

| 50 | 2.7778 | 2.7027 | 2.6316 | 2.5641 | 2.5000 |

[28][29]

41%~45%

| 利率——期数 | 41% | 42% | 43% | 44% | 45% |

|---|---|---|---|---|---|

| 1 | 0.7092 | 0.7042 | 0.6993 | 0.6944 | 0.6897 |

| 2 | 1.2122 | 1.2002 | 1.1883 | 1.1767 | 1.1652 |

| 3 | 1.5689 | 1.5494 | 1.5303 | 1.5116 | 1.4933 |

| 4 | 1.8219 | 1.7954 | 1.7694 | 1.7442 | 1.7195 |

| 5 | 2.0014 | 1.9686 | 1.9367 | 1.9057 | 1.8755 |

| 6 | 2.1286 | 2.0905 | 2.0536 | 2.0178 | 1.9831 |

| 7 | 2.2189 | 2.1764 | 2.1354 | 2.0957 | 2.0573 |

| 8 | 2.2829 | 2.2369 | 2.1926 | 2.1498 | 2.1085 |

| 9 | 2.3283 | 2.2795 | 2.2326 | 2.1874 | 2.1438 |

| 10 | 2.3605 | 2.3095 | 2.2605 | 2.2134 | 2.1681 |

| 11 | 2.3833 | 2.3307 | 2.2801 | 2.2316 | 2.1849 |

| 12 | 2.3995 | 2.3455 | 2.2938 | 2.2441 | 2.1965 |

| 13 | 2.4110 | 2.3560 | 2.3033 | 2.2529 | 2.2045 |

| 14 | 2.4192 | 2.3634 | 2.3100 | 2.2589 | 2.2100 |

| 15 | 2.4249 | 2.3686 | 2.3147 | 2.2632 | 2.2138 |

| 16 | 2.4290 | 2.3722 | 2.3180 | 2.2661 | 2.2164 |

| 17 | 2.4319 | 2.3748 | 2.3203 | 2.2681 | 2.2182 |

| 18 | 2.4340 | 2.3766 | 2.3219 | 2.2695 | 2.2195 |

| 19 | 2.4355 | 2.3779 | 2.3230 | 2.2705 | 2.2203 |

| 20 | 2.4365 | 2.3788 | 2.3238 | 2.2712 | 2.2209 |

| 21 | 2.4372 | 2.3794 | 2.3243 | 2.2717 | 2.2213 |

| 22 | 2.4377 | 2.3799 | 2.3247 | 2.2720 | 2.2216 |

| 23 | 2.4381 | 2.3802 | 2.3250 | 2.2722 | 2.2218 |

| 24 | 2.4384 | 2.3804 | 2.3251 | 2.2724 | 2.2219 |

| 25 | 2.4386 | 2.3806 | 2.3253 | 2.2725 | 2.2220 |

| 26 | 2.4387 | 2.3807 | 2.3254 | 2.2726 | 2.2221 |

| 27 | 2.4388 | 2.3808 | 2.3254 | 2.2726 | 2.2221 |

| 28 | 2.4389 | 2.3808 | 2.3255 | 2.2726 | 2.2222 |

| 29 | 2.4389 | 2.3809 | 2.3255 | 2.2727 | 2.2222 |

| 30 | 2.4389 | 2.3809 | 2.3255 | 2.2727 | 2.2222 |

| 31 | 2.4390 | 2.3809 | 2.3255 | 2.2727 | 2.2222 |

| 32 | 2.4390 | 2.3809 | 2.3256 | 2.2727 | 2.2222 |

| 33 | 2.4390 | 2.3809 | 2.3256 | 2.2727 | 2.2222 |

| 34 | 2.4390 | 2.3809 | 2.3256 | 2.2727 | 2.2222 |

| 35 | 2.4390 | 2.3809 | 2.3256 | 2.2727 | 2.2222 |

| 36 | 2.4390 | 2.3809 | 2.3256 | 2.2727 | 2.2222 |

| 37 | 2.4390 | 2.3809 | 2.3256 | 2.2727 | 2.2222 |

| 38 | 2.4390 | 2.3809 | 2.3256 | 2.2727 | 2.2222 |

| 39 | 2.4390 | 2.3809 | 2.3256 | 2.2727 | 2.2222 |

| 40 | 2.4390 | 2.3810 | 2.3256 | 2.2727 | 2.2222 |

| 41 | 2.4390 | 2.3810 | 2.3256 | 2.2727 | 2.2222 |

| 42 | 2.4390 | 2.3810 | 2.3256 | 2.2727 | 2.2222 |

| 43 | 2.4390 | 2.3810 | 2.3256 | 2.2727 | 2.2222 |

| 44 | 2.4390 | 2.3810 | 2.3256 | 2.2727 | 2.2222 |

| 45 | 2.4390 | 2.3810 | 2.3256 | 2.2727 | 2.2222 |

| 46 | 2.4390 | 2.3810 | 2.3256 | 2.2727 | 2.2222 |

| 47 | 2.4390 | 2.3810 | 2.3256 | 2.2727 | 2.2222 |

| 48 | 2.4390 | 2.3810 | 2.3256 | 2.2727 | 2.2222 |

| 49 | 2.4390 | 2.3810 | 2.3256 | 2.2727 | 2.2222 |

| 50 | 2.4390 | 2.3810 | 2.3256 | 2.2727 | 2.2222 |

[28][29]

46%~50%

| 利率——期数 | 46% | 47% | 48% | 49% | 50% |

|---|---|---|---|---|---|

| 1 | 0.6849 | 0.6803 | 0.6757 | 0.6711 | 0.6667 |

| 2 | 1.1541 | 1.1430 | 1.1322 | 1.1216 | 1.1111 |

| 3 | 1.4754 | 1.4579 | 1.4407 | 1.4239 | 1.4074 |

| 4 | 1.6955 | 1.6720 | 1.6491 | 1.6268 | 1.6049 |

| 5 | 1.8462 | 1.8177 | 1.7899 | 1.7629 | 1.7366 |

| 6 | 1.9495 | 1.9168 | 1.8851 | 1.8543 | 1.8244 |

| 7 | 2.0202 | 1.9842 | 1.9494 | 1.9156 | 1.8829 |

| 8 | 2.0686 | 2.0301 | 1.9928 | 1.9568 | 1.9220 |

| 9 | 2.1018 | 2.0613 | 2.0222 | 1.9844 | 1.9480 |

| 10 | 2.1245 | 2.0825 | 2.0420 | 2.0030 | 1.9653 |

| 11 | 2.1401 | 2.0969 | 2.0554 | 2.0154 | 1.9769 |

| 12 | 2.1507 | 2.1068 | 2.0645 | 2.0237 | 1.9846 |

| 13 | 2.1580 | 2.1134 | 2.0706 | 2.0294 | 1.9897 |

| 14 | 2.1630 | 2.1180 | 2.0747 | 2.0331 | 1.9931 |

| 15 | 2.1665 | 2.1211 | 2.0775 | 2.0357 | 1.9954 |

| 16 | 2.1688 | 2.1232 | 2.0794 | 2.0374 | 1.9970 |

| 17 | 2.1704 | 2.1246 | 2.0807 | 2.0385 | 1.9980 |

| 18 | 2.1715 | 2.1256 | 2.0815 | 2.0393 | 1.9986 |

| 19 | 2.1723 | 2.1263 | 2.0821 | 2.0398 | 1.9991 |

| 20 | 2.1728 | 2.1267 | 2.0825 | 2.0401 | 1.9994 |

| 21 | 2.1731 | 2.1270 | 2.0828 | 2.0403 | 1.9996 |

| 22 | 2.1734 | 2.1272 | 2.0830 | 2.0405 | 1.9997 |

| 23 | 2.1736 | 2.1274 | 2.0831 | 2.0406 | 1.9998 |

| 24 | 2.1737 | 2.1275 | 2.0832 | 2.0407 | 1.9999 |

| 25 | 2.1737 | 2.1275 | 2.0832 | 2.0407 | 1.9999 |

| 26 | 2.1738 | 2.1276 | 2.0833 | 2.0408 | 1.9999 |

| 27 | 2.1738 | 2.1276 | 2.0833 | 2.0408 | 2.0000 |

| 28 | 2.1739 | 2.1276 | 2.0833 | 2.0408 | 2.0000 |

| 29 | 2.1739 | 2.1276 | 2.0833 | 2.0408 | 2.0000 |

| 30 | 2.1739 | 2.1276 | 2.0833 | 2.0408 | 2.0000 |

| 31 | 2.1739 | 2.1276 | 2.0833 | 2.0408 | 2.0000 |

| 32 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 33 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 34 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 35 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 36 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 37 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 38 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 39 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 40 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 41 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 42 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 43 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 44 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 45 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 46 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 47 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 48 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 49 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

| 50 | 2.1739 | 2.1277 | 2.0833 | 2.0408 | 2.0000 |

[28][29]

作用

| 利率——期间 | 1% | 2% | 3% | 4% | 5% |

|---|---|---|---|---|---|

| 1 | 0.9901 | 0.9804 | 0.9709 | 0.9615 | 0.9524 |

| 2 | 1.9704 | 1.9416 | 1.9135 | 1.8861 | 1.8594 |

| 3 | 2.9410 | 2.8839 | 2.8286 | 2.7751 | 2.7232 |

| 4 | 3.9020 | 3.8077 | 3.7171 | 3.6299 | 3.5460 |

| 5 | 4.8534 | 4.7135 | 4.5797 | 4.4518 | 4.3295 |

| 6 | 5.7955 | 5.6014 | 5.4172 | 5.2421 | 5.0757 |

| 7 | 6.7282 | 6.4720 | 6.2303 | 6.0021 | 5.7864 |

| 8 | 7.6517 | 7.3255 | 7.0197 | 6.7327 | 6.4632 |

| 9 | 8.5660 | 8.1622 | 7.7861 | 7.4353 | 7.1078 |

| 10 | 9.4713 | 8.9826 | 8.5302 | 8.1109 | 7.7217 |

| 11 | 10.3676 | 9.7868 | 9.2526 | 8.7605 | 8.3064 |

| 12 | 11.2551 | 10.5753 | 9.9540 | 9.3851 | 8.8633 |

| 13 | 12.1337 | 11.3484 | 10.6350 | 9.9856 | 9.3936 |

| 14 | 13.0037 | 12.1062 | 11.2961 | 10.5631 | 9.8986 |

| 15 | 13.8651 | 12.8493 | 11.9379 | 11.1184 | 10.3797 |

| 16 | 14.7179 | 13.5777 | 12.5611 | 11.6523 | 10.8378 |

| 17 | 15.5623 | 14.2919 | 13.1661 | 12.1657 | 11.2740 |

| 18 | 16.3983 | 14.9920 | 13.7535 | 12.6593 | 11.6896 |

| 19 | 17.2260 | 15.6785 | 14.3238 | 13.1340 | 12.0853 |

| 20 | 18.0456 | 16.3514 | 14.8775 | 13.5903 | 12.4622 |

| 21 | 18.8570 | 17.0112 | 15.4150 | 14.0292 | 12.8212 |

| 22 | 19.6604 | 17.6580 | 15.9369 | 14.4511 | 13.1630 |

| 23 | 20.4558 | 18.2922 | 16.4436 | 14.8568 | 13.4886 |

| 24 | 21.2434 | 18.9139 | 16.9355 | 15.2470 | 13.7986 |

| 25 | 22.0232 | 19.5235 | 17.4131 | 15.6221 | 14.0939 |

| 26 | 22.7952 | 20.1210 | 17.8768 | 15.9828 | 14.3752 |

| 27 | 23.5596 | 20.7069 | 18.3270 | 16.3296 | 14.6430 |

| 28 | 24.3164 | 21.2813 | 18.7641 | 16.6631 | 14.8981 |

| 29 | 25.0658 | 21.8444 | 19.1885 | 16.9837 | 15.1411 |

| 30 | 25.8077 | 22.3965 | 19.6004 | 17.2920 | 15.3725 |

| 31 | 26.5423 | 22.9377 | 20.0004 | 17.5885 | 15.5928 |

| 32 | 27.2696 | 23.4683 | 20.3888 | 17.8736 | 15.8027 |

| 33 | 27.9897 | 23.9886 | 20.7658 | 18.1476 | 16.0025 |

| 34 | 28.7027 | 24.4986 | 21.1318 | 18.4112 | 16.1929 |

| 35 | 29.4086 | 24.9986 | 21.4872 | 18.6646 | 16.3742 |

| 36 | 30.1076 | 25.4888 | 21.8323 | 18.9083 | 16.5469 |

| 37 | 30.7995 | 25.9695 | 22.1672 | 19.1426 | 16.7113 |

| 38 | 31.4847 | 26.4406 | 22.4925 | 19.3679 | 16.8679 |

| 39 | 32.1630 | 26.9026 | 22.8082 | 19.5845 | 17.0170 |

| 40 | 32.8347 | 27.3555 | 23.1148 | 19.7928 | 17.1591 |

| 41 | 33.4997 | 27.7995 | 23.4124 | 19.9931 | 17.2944 |

| 42 | 34.1581 | 28.2348 | 23.7014 | 20.1856 | 17.4232 |

| 43 | 34.8100 | 28.6616 | 23.9819 | 20.3708 | 17.5459 |

| 44 | 35.4555 | 29.0800 | 24.2543 | 20.5488 | 17.6628 |

| 45 | 36.0945 | 29.4902 | 24.5187 | 20.7200 | 17.7741 |

| 46 | 36.7272 | 29.8923 | 24.7754 | 20.8847 | 17.8801 |

| 47 | 37.3537 | 30.2866 | 25.0247 | 21.0429 | 17.9810 |

| 48 | 37.9740 | 30.6731 | 25.2667 | 21.1951 | 18.0772 |

| 49 | 38.5881 | 31.0521 | 25.5017 | 21.3414 | 18.1687 |

| 50 | 39.1961 | 31.4236 | 25.7298 | 21.4822 | 18.2559 |

计算货币价值

| 利率——期数 | 6% | 7% | 8% | 9% | 10% |

|---|---|---|---|---|---|

| 1 | 0.9434 | 0.9346 | 0.9259 | 0.9174 | 0.9091 |

| 2 | 1.8334 | 1.8080 | 1.7833 | 1.7591 | 1.7355 |

| 3 | 2.6730 | 2.6243 | 2.5771 | 2.5313 | 2.4869 |

| 4 | 3.4651 | 3.3872 | 3.3121 | 3.2397 | 3.1699 |

| 5 | 4.2124 | 4.1002 | 3.9927 | 3.8897 | 3.7908 |

| 6 | 4.9173 | 4.7665 | 4.6228 | 4.4859 | 4.3553 |

| 7 | 5.5824 | 5.3893 | 5.2064 | 5.0330 | 4.8684 |

| 8 | 6.2098 | 5.9713 | 5.7466 | 5.5348 | 5.3349 |

| 9 | 6.8017 | 6.5152 | 6.2469 | 5.9952 | 5.7590 |

| 10 | 7.3601 | 7.0236 | 6.7101 | 6.4176 | 6.1446 |

| 11 | 7.8869 | 7.4987 | 7.1390 | 6.8052 | 6.4951 |

| 12 | 8.3838 | 7.9427 | 7.5361 | 7.1607 | 6.8137 |

| 13 | 8.8527 | 8.3577 | 7.9038 | 7.4869 | 7.1034 |

| 14 | 9.2950 | 8.7455 | 8.2442 | 7.7862 | 7.3667 |

| 15 | 9.7122 | 9.1079 | 8.5595 | 8.0607 | 7.6061 |

| 16 | 10.1059 | 9.4466 | 8.8514 | 8.3126 | 7.8237 |

| 17 | 10.4773 | 9.7632 | 9.1216 | 8.5436 | 8.0216 |

| 18 | 10.8276 | 10.0591 | 9.3719 | 8.7556 | 8.2014 |

| 19 | 11.1581 | 10.3356 | 9.6036 | 8.9501 | 8.3649 |

| 20 | 11.4699 | 10.5940 | 9.8181 | 9.1285 | 8.5136 |

| 21 | 11.7641 | 10.8355 | 10.0168 | 9.2922 | 8.6487 |

| 22 | 12.0416 | 11.0612 | 10.2007 | 9.4424 | 8.7715 |

| 23 | 12.3034 | 11.2722 | 10.3711 | 9.5802 | 8.8832 |

| 24 | 12.5504 | 11.4693 | 10.5288 | 9.7066 | 8.9847 |

| 25 | 12.7834 | 11.6536 | 10.6748 | 9.8226 | 9.0770 |

| 26 | 13.0032 | 11.8258 | 10.8100 | 9.9290 | 9.1609 |

| 27 | 13.2105 | 11.9867 | 10.9352 | 10.0266 | 9.2372 |

| 28 | 13.4062 | 12.1371 | 11.0511 | 10.1161 | 9.3066 |

| 29 | 13.5907 | 12.2777 | 11.1584 | 10.1983 | 9.3696 |

| 30 | 13.7648 | 12.4090 | 11.2578 | 10.2737 | 9.4269 |

| 31 | 13.9291 | 12.5318 | 11.3498 | 10.3428 | 9.4790 |

| 32 | 14.0840 | 12.6466 | 11.4350 | 10.4062 | 9.5264 |

| 33 | 14.2302 | 12.7538 | 11.5139 | 10.4644 | 9.5694 |

| 34 | 14.3681 | 12.8540 | 11.5869 | 10.5178 | 9.6086 |

| 35 | 14.4982 | 12.9477 | 11.6546 | 10.5668 | 9.6442 |

| 36 | 14.6210 | 13.0352 | 11.7172 | 10.6118 | 9.6765 |

| 37 | 14.7368 | 13.1170 | 11.7752 | 10.6530 | 9.7059 |

| 38 | 14.8460 | 13.1935 | 11.8289 | 10.6908 | 9.7327 |

| 39 | 14.9491 | 13.2649 | 11.8786 | 10.7255 | 9.7570 |

| 40 | 15.0463 | 13.3317 | 11.9246 | 10.7574 | 9.7791 |

| 41 | 15.1380 | 13.3941 | 11.9672 | 10.7866 | 9.7991 |

| 42 | 15.2245 | 13.4524 | 12.0067 | 10.8133 | 9.8174 |

| 43 | 15.3062 | 13.5070 | 12.0432 | 10.8380 | 9.8340 |

| 44 | 15.3832 | 13.5579 | 12.0771 | 10.8605 | 9.8491 |

| 45 | 15.4558 | 13.6055 | 12.1084 | 10.8812 | 9.8628 |

| 46 | 15.5244 | 13.6500 | 12.1374 | 10.9002 | 9.8753 |

| 47 | 15.5890 | 13.6916 | 12.1643 | 10.9176 | 9.8866 |

| 48 | 15.6500 | 13.7305 | 12.1892 | 10.9336 | 9.8969 |

| 49 | 15.7076 | 13.7668 | 12.2122 | 10.9482 | 9.9063 |

| 50 | 15.7619 | 13.8007 | 12.2335 | 10.9617 | 9.9148 |

比较投资方案

| 利率——期数 | 11% | 12% | 13% | 14% | 15% |

|---|---|---|---|---|---|

| 1 | 0.9009 | 0.8929 | 0.8850 | 0.8772 | 0.8696 |

| 2 | 1.7125 | 1.6901 | 1.6681 | 1.6466 | 1.6257 |

| 3 | 2.4437 | 2.4018 | 2.3612 | 2.3216 | 2.2832 |

| 4 | 3.1024 | 3.0373 | 2.9745 | 2.9137 | 2.8550 |

| 5 | 3.6958 | 3.6048 | 3.5172 | 3.4331 | 3.3522 |

| 6 | 4.2305 | 4.1114 | 3.9975 | 3.8887 | 3.7845 |

| 7 | 4.7122 | 4.5638 | 4.4226 | 4.2883 | 4.1604 |

| 8 | 5.1461 | 4.9676 | 4.7988 | 4.6389 | 4.4873 |

| 9 | 5.5370 | 5.3282 | 5.1317 | 4.9464 | 4.7716 |

| 10 | 5.8892 | 5.6502 | 5.4262 | 5.2161 | 5.0188 |

| 11 | 6.2065 | 5.9377 | 5.6869 | 5.4527 | 5.2337 |

| 12 | 6.4924 | 6.1944 | 5.9176 | 5.6603 | 5.4206 |

| 13 | 6.7499 | 6.4235 | 6.1218 | 5.8424 | 5.5831 |

| 14 | 6.9819 | 6.6282 | 6.3025 | 6.0021 | 5.7245 |

| 15 | 7.1909 | 6.8109 | 6.4624 | 6.1422 | 5.8474 |

| 16 | 7.3792 | 6.9740 | 6.6039 | 6.2651 | 5.9542 |

| 17 | 7.5488 | 7.1196 | 6.7291 | 6.3729 | 6.0472 |

| 18 | 7.7016 | 7.2497 | 6.8399 | 6.4674 | 6.1280 |

| 19 | 7.8393 | 7.3657 | 6.9380 | 6.5504 | 6.1982 |

| 20 | 7.9633 | 7.4694 | 7.0248 | 6.6231 | 6.2593 |

| 21 | 8.0751 | 7.5620 | 7.1016 | 6.6870 | 6.3125 |

| 22 | 8.1757 | 7.6446 | 7.1695 | 6.7429 | 6.3587 |

| 23 | 8.2664 | 7.7184 | 7.2297 | 6.7921 | 6.3988 |

| 24 | 8.3481 | 7.7843 | 7.2829 | 6.8351 | 6.4338 |

| 25 | 8.4217 | 7.8431 | 7.3300 | 6.8729 | 6.4641 |

| 26 | 8.4881 | 7.8957 | 7.3717 | 6.9061 | 6.4906 |

| 27 | 8.5478 | 7.9426 | 7.4086 | 6.9352 | 6.5135 |

| 28 | 8.6016 | 7.9844 | 7.4412 | 6.9607 | 6.5335 |

| 29 | 8.6501 | 8.0218 | 7.4701 | 6.9830 | 6.5509 |

| 30 | 8.6938 | 8.0552 | 7.4957 | 7.0027 | 6.5660 |

| 31 | 8.7331 | 8.0850 | 7.5183 | 7.0199 | 6.5791 |

| 32 | 8.7686 | 8.1116 | 7.5382 | 7.0350 | 6.5905 |

| 33 | 8.8005 | 8.1354 | 7.5560 | 7.0482 | 6.6005 |

| 34 | 8.8293 | 8.1566 | 7.5717 | 7.0599 | 6.6091 |

| 35 | 8.8552 | 8.1755 | 7.5856 | 7.0700 | 6.6166 |

| 36 | 8.8786 | 8.1924 | 7.5979 | 7.0790 | 6.6231 |

| 37 | 8.8996 | 8.2075 | 7.6087 | 7.0868 | 6.6288 |

| 38 | 8.9186 | 8.2210 | 7.6183 | 7.0937 | 6.6338 |

| 39 | 8.9357 | 8.2330 | 7.6268 | 7.0997 | 6.6380 |

| 40 | 8.9511 | 8.2438 | 7.6344 | 7.1050 | 6.6418 |

| 41 | 8.9649 | 8.2534 | 7.6410 | 7.1097 | 6.6450 |

| 42 | 8.9774 | 8.2619 | 7.6469 | 7.1138 | 6.6478 |

| 43 | 8.9886 | 8.2696 | 7.6522 | 7.1173 | 6.6503 |

| 44 | 8.9988 | 8.2764 | 7.6568 | 7.1205 | 6.6524 |

| 45 | 9.0079 | 8.2825 | 7.6609 | 7.1232 | 6.6543 |

| 46 | 9.0161 | 8.2880 | 7.6645 | 7.1256 | 6.6559 |

| 47 | 9.0235 | 8.2928 | 7.6677 | 7.1277 | 6.6573 |

| 48 | 9.0302 | 8.2972 | 7.6705 | 7.1296 | 6.6585 |

| 49 | 9.0362 | 8.3010 | 7.6730 | 7.1312 | 6.6596 |

| 50 | 9.0417 | 8.3045 | 7.6752 | 7.1327 | 6.6605 |

比较方案优劣

| 利率——期数 | 16% | 17% | 18% | 19% | 20% |

|---|---|---|---|---|---|

| 1 | 0.8621 | 0.8547 | 0.8475 | 0.8403 | 0.8333 |

| 2 | 1.6052 | 1.5852 | 1.5656 | 1.5465 | 1.5278 |

| 3 | 2.2459 | 2.2096 | 2.1743 | 2.1399 | 2.1065 |

| 4 | 2.7982 | 2.7432 | 2.6901 | 2.6386 | 2.5887 |

| 5 | 3.2743 | 3.1993 | 3.1272 | 3.0576 | 2.9906 |

| 6 | 3.6847 | 3.5892 | 3.4976 | 3.4098 | 3.3255 |

| 7 | 4.0386 | 3.9224 | 3.8115 | 3.7057 | 3.6046 |

| 8 | 4.3436 | 4.2072 | 4.0776 | 3.9544 | 3.8372 |

| 9 | 4.6065 | 4.4506 | 4.3030 | 4.1633 | 4.0310 |

| 10 | 4.8332 | 4.6586 | 4.4941 | 4.3389 | 4.1925 |

| 11 | 5.0286 | 4.8364 | 4.6560 | 4.4865 | 4.3271 |

| 12 | 5.1971 | 4.9884 | 4.7932 | 4.6105 | 4.4392 |

| 13 | 5.3423 | 5.1183 | 4.9095 | 4.7147 | 4.5327 |

| 14 | 5.4675 | 5.2293 | 5.0081 | 4.8023 | 4.6106 |

| 15 | 5.5755 | 5.3242 | 5.0916 | 4.8759 | 4.6755 |

| 16 | 5.6685 | 5.4053 | 5.1624 | 4.9377 | 4.7296 |

| 17 | 5.7487 | 5.4746 | 5.2223 | 4.9897 | 4.7746 |

| 18 | 5.8178 | 5.5339 | 5.2732 | 5.0333 | 4.8122 |

| 19 | 5.8775 | 5.5845 | 5.3162 | 5.0700 | 4.8435 |

| 20 | 5.9288 | 5.6278 | 5.3527 | 5.1009 | 4.8696 |

| 21 | 5.9731 | 5.6647 | 5.3837 | 5.1268 | 4.8913 |

| 22 | 6.0113 | 5.6964 | 5.4099 | 5.1486 | 4.9094 |

| 23 | 6.0442 | 5.7234 | 5.4321 | 5.1668 | 4.9245 |

| 24 | 6.0726 | 5.7465 | 5.4509 | 5.1822 | 4.9371 |

| 25 | 6.0971 | 5.7662 | 5.4669 | 5.1951 | 4.9475 |

| 26 | 6.1182 | 5.7831 | 5.4804 | 5.2060 | 4.9563 |

| 27 | 6.1364 | 5.7975 | 5.4919 | 5.2151 | 4.9636 |

| 28 | 6.1520 | 5.8099 | 5.5016 | 5.2228 | 4.9697 |

| 29 | 6.1656 | 5.8204 | 5.5098 | 5.2292 | 4.9747 |

| 30 | 6.1772 | 5.8294 | 5.5168 | 5.2347 | 4.9789 |

| 31 | 6.1872 | 5.8371 | 5.5227 | 5.2392 | 4.9824 |

| 32 | 6.1958 | 5.8437 | 5.5277 | 5.2430 | 4.9854 |

| 33 | 6.2034 | 5.8493 | 5.5320 | 5.2462 | 4.9878 |

| 34 | 6.2098 | 5.8541 | 5.5356 | 5.2489 | 4.9898 |

| 35 | 6.2153 | 5.8582 | 5.5386 | 5.2512 | 4.9915 |

| 36 | 6.2201 | 5.8617 | 5.5412 | 5.2531 | 4.9929 |

| 37 | 6.2242 | 5.8647 | 5.5434 | 5.2547 | 4.9941 |

| 38 | 6.2278 | 5.8673 | 5.5452 | 5.2561 | 4.9951 |

| 39 | 6.2309 | 5.8695 | 5.5468 | 5.2572 | 4.9959 |

| 40 | 6.2335 | 5.8713 | 5.5482 | 5.2582 | 4.9966 |

| 41 | 6.2358 | 5.8729 | 5.5493 | 5.2590 | 4.9972 |

| 42 | 6.2377 | 5.8743 | 5.5502 | 5.2596 | 4.9976 |

| 43 | 6.2394 | 5.8755 | 5.5510 | 5.2602 | 4.9980 |

| 44 | 6.2409 | 5.8765 | 5.5517 | 5.2607 | 4.9984 |

| 45 | 6.2421 | 5.8773 | 5.5523 | 5.2611 | 4.9986 |

| 46 | 6.2432 | 5.8781 | 5.5528 | 5.2614 | 4.9989 |

| 47 | 6.2442 | 5.8787 | 5.5532 | 5.2617 | 4.9991 |

| 48 | 6.2450 | 5.8792 | 5.5536 | 5.2619 | 4.9992 |

| 49 | 6.2457 | 5.8797 | 5.5539 | 5.2621 | 4.9993 |

| 50 | 6.2463 | 5.8801 | 5.5541 | 5.2623 | 4.9995 |

计算报酬率

| 利率——期数 | 21% | 22% | 23% | 24% | 25% |

|---|---|---|---|---|---|

| 1 | 0.8264 | 0.8197 | 0.8130 | 0.8065 | 0.8000 |

| 2 | 1.5095 | 1.4915 | 1.4740 | 1.4568 | 1.4400 |

| 3 | 2.0739 | 2.0422 | 2.0114 | 1.9813 | 1.9520 |

| 4 | 2.5404 | 2.4936 | 2.4483 | 2.4043 | 2.3616 |

| 5 | 2.9260 | 2.8636 | 2.8035 | 2.7454 | 2.6893 |

| 6 | 3.2446 | 3.1669 | 3.0923 | 3.0205 | 2.9514 |

| 7 | 3.5079 | 3.4155 | 3.3270 | 3.2423 | 3.1611 |

| 8 | 3.7256 | 3.6193 | 3.5179 | 3.4212 | 3.3289 |

| 9 | 3.9054 | 3.7863 | 3.6731 | 3.5655 | 3.4631 |

| 10 | 4.0541 | 3.9232 | 3.7993 | 3.6819 | 3.5705 |

| 11 | 4.1769 | 4.0354 | 3.9018 | 3.7757 | 3.6564 |

| 12 | 4.2784 | 4.1274 | 3.9852 | 3.8514 | 3.7251 |

| 13 | 4.3624 | 4.2028 | 4.0530 | 3.9124 | 3.7801 |

| 14 | 4.4317 | 4.2646 | 4.1082 | 3.9616 | 3.8241 |

| 15 | 4.4890 | 4.3152 | 4.1530 | 4.0013 | 3.8593 |

| 16 | 4.5364 | 4.3567 | 4.1894 | 4.0333 | 3.8874 |

| 17 | 4.5755 | 4.3908 | 4.2190 | 4.0591 | 3.9099 |

| 18 | 4.6079 | 4.4187 | 4.2431 | 4.0799 | 3.9279 |

| 19 | 4.6346 | 4.4415 | 4.2627 | 4.0967 | 3.9424 |

| 20 | 4.6566 | 4.4603 | 4.2786 | 4.1103 | 3.9539 |

| 21 | 4.6750 | 4.4756 | 4.2916 | 4.1212 | 3.9631 |

| 22 | 4.6900 | 4.4882 | 4.3021 | 4.1300 | 3.9705 |

| 23 | 4.7025 | 4.4985 | 4.3106 | 4.1371 | 3.9764 |

| 24 | 4.7128 | 4.5070 | 4.3176 | 4.1428 | 3.9811 |

| 25 | 4.7213 | 4.5139 | 4.3232 | 4.1474 | 3.9849 |

| 26 | 4.7284 | 4.5196 | 4.3278 | 4.1511 | 3.9879 |

| 27 | 4.7342 | 4.5243 | 4.3316 | 4.1542 | 3.9903 |

| 28 | 4.7390 | 4.5281 | 4.3346 | 4.1566 | 3.9923 |

| 29 | 4.7430 | 4.5312 | 4.3371 | 4.1585 | 3.9938 |

| 30 | 4.7463 | 4.5338 | 4.3391 | 4.1601 | 3.9950 |

| 31 | 4.7490 | 4.5359 | 4.3407 | 4.1614 | 3.9960 |

| 32 | 4.7512 | 4.5376 | 4.3421 | 4.1624 | 3.9968 |

| 33 | 4.7531 | 4.5390 | 4.3431 | 4.1632 | 3.9975 |

| 34 | 4.7546 | 4.5402 | 4.3440 | 4.1639 | 3.9980 |

| 35 | 4.7559 | 4.5411 | 4.3447 | 4.1644 | 3.9984 |

| 36 | 4.7569 | 4.5419 | 4.3453 | 4.1649 | 3.9987 |

| 37 | 4.7578 | 4.5426 | 4.3458 | 4.1652 | 3.9990 |

| 38 | 4.7585 | 4.5431 | 4.3462 | 4.1655 | 3.9992 |

| 39 | 4.7590 | 4.5435 | 4.3465 | 4.1657 | 3.9993 |

| 40 | 4.7596 | 4.5439 | 4.3467 | 4.1659 | 3.9995 |

| 41 | 4.7600 | 4.5441 | 4.3469 | 4.1661 | 3.9996 |

| 42 | 4.7603 | 4.5444 | 4.3471 | 4.1662 | 3.9997 |

| 43 | 4.7606 | 4.5446 | 4.3472 | 4.1663 | 3.9997 |

| 44 | 4.7608 | 4.5447 | 4.3473 | 4.1663 | 3.9998 |

| 45 | 4.7610 | 4.5448 | 4.3474 | 4.1664 | 3.9998 |

| 46 | 4.7612 | 4.5450 | 4.3475 | 4.1665 | 3.9999 |

| 47 | 4.7613 | 4.5451 | 4.3476 | 4.1665 | 3.9999 |

| 48 | 4.7614 | 4.5451 | 4.3476 | 4.1665 | 3.9999 |

| 49 | 4.7615 | 4.5452 | 4.3477 | 4.1666 | 3.9999 |

| 50 | 4.7616 | 4.5452 | 4.3477 | 4.1666 | 3.9999 |

词条图册

| 利率——期数 | 26% | 27% | 28% | 29% | 30% |

|---|---|---|---|---|---|

| 1 | 0.7937 | 0.7874 | 0.7813 | 0.7752 | 0.7692 |

| 2 | 1.4235 | 1.4074 | 1.3916 | 1.3761 | 1.3609 |

| 3 | 1.9234 | 1.8956 | 1.8684 | 1.8420 | 1.8161 |

| 4 | 2.3202 | 2.2800 | 2.2410 | 2.2031 | 2.1662 |

| 5 | 2.6351 | 2.5827 | 2.5320 | 2.4830 | 2.4356 |

| 6 | 2.8850 | 2.8210 | 2.7594 | 2.7000 | 2.6427 |

| 7 | 3.0833 | 3.0087 | 2.9370 | 2.8682 | 2.8021 |

| 8 | 3.2407 | 3.1564 | 3.0758 | 2.9986 | 2.9247 |

| 9 | 3.3657 | 3.2728 | 3.1842 | 3.0997 | 3.0190 |

| 10 | 3.4648 | 3.3644 | 3.2689 | 3.1780 | 3.0915 |

| 11 | 3.5435 | 3.4365 | 3.3351 | 3.2388 | 3.1473 |

| 12 | 3.6059 | 3.4933 | 3.3868 | 3.2859 | 3.1903 |

| 13 | 3.6555 | 3.5381 | 3.4272 | 3.3224 | 3.2233 |

| 14 | 3.6949 | 3.5733 | 3.4587 | 3.3507 | 3.2487 |

| 15 | 3.7261 | 3.6010 | 3.4834 | 3.3726 | 3.2682 |

| 16 | 3.7509 | 3.6228 | 3.5026 | 3.3896 | 3.2832 |

| 17 | 3.7705 | 3.6400 | 3.5177 | 3.4028 | 3.2948 |

| 18 | 3.7861 | 3.6536 | 3.5294 | 3.4130 | 3.3037 |

| 19 | 3.7985 | 3.6642 | 3.5386 | 3.4210 | 3.3105 |

| 20 | 3.8083 | 3.6726 | 3.5458 | 3.4271 | 3.3158 |

| 21 | 3.8161 | 3.6792 | 3.5514 | 3.4318 | 3.3198 |

| 22 | 3.8223 | 3.6844 | 3.5558 | 3.4356 | 3.3230 |

| 23 | 3.8273 | 3.6885 | 3.5592 | 3.4384 | 3.3254 |

| 24 | 3.8312 | 3.6918 | 3.5619 | 3.4406 | 3.3272 |

| 25 | 3.8342 | 3.6943 | 3.5640 | 3.4423 | 3.3286 |

| 26 | 3.8367 | 3.6963 | 3.5656 | 3.4437 | 3.3297 |

| 27 | 3.8387 | 3.6979 | 3.5669 | 3.4447 | 3.3306 |

| 28 | 3.8402 | 3.6991 | 3.5679 | 3.4455 | 3.3312 |

| 29 | 3.8414 | 3.7001 | 3.5687 | 3.4461 | 3.3317 |

| 30 | 3.8424 | 3.7009 | 3.5693 | 3.4466 | 3.3321 |

| 31 | 3.8432 | 3.7015 | 3.5697 | 3.4470 | 3.3324 |

| 32 | 3.8438 | 3.7019 | 3.5701 | 3.4473 | 3.3326 |

| 33 | 3.8443 | 3.7023 | 3.5704 | 3.4475 | 3.3328 |

| 34 | 3.8447 | 3.7026 | 3.5706 | 3.4477 | 3.3329 |

| 35 | 3.8450 | 3.7028 | 3.5708 | 3.4478 | 3.3330 |

| 36 | 3.8452 | 3.7030 | 3.5709 | 3.4479 | 3.3331 |

| 37 | 3.8454 | 3.7032 | 3.5710 | 3.4480 | 3.3331 |

| 38 | 3.8456 | 3.7033 | 3.5711 | 3.4481 | 3.3332 |

| 39 | 3.8457 | 3.7034 | 3.5712 | 3.4481 | 3.3332 |

| 40 | 3.8458 | 3.7034 | 3.5712 | 3.4481 | 3.3332 |

| 41 | 3.8459 | 3.7035 | 3.5713 | 3.4482 | 3.3333 |

| 42 | 3.8459 | 3.7035 | 3.5713 | 3.4482 | 3.3333 |

| 43 | 3.8460 | 3.7036 | 3.5713 | 3.4482 | 3.3333 |

| 44 | 3.8460 | 3.7036 | 3.5714 | 3.4482 | 3.3333 |

| 45 | 3.8460 | 3.7036 | 3.5714 | 3.4482 | 3.3333 |

| 46 | 3.8461 | 3.7036 | 3.5714 | 3.4482 | 3.3333 |

| 47 | 3.8461 | 3.7037 | 3.5714 | 3.4483 | 3.3333 |

| 48 | 3.8461 | 3.7037 | 3.5714 | 3.4483 | 3.3333 |

| 49 | 3.8461 | 3.7037 | 3.5714 | 3.4483 | 3.3333 |

| 50 | 3.8461 | 3.7037 | 3.5714 | 3.4483 | 3.3333 |

-

呼和浩特探岳现金优惠3.5万 成都丰田锐志最高优惠2.2万

2025-11-03 22:23:31 查看详情 -

西安大众速腾现金优惠2.3万 成都沃尔沃XC90优惠三万元

2025-11-03 22:23:31 查看详情 -

西安大众速腾现金优惠2.3万 驾驭快感

2025-11-03 22:23:31 查看详情 -

呼和浩特探岳现金优惠3.5万 再送装潢礼包

2025-11-03 22:23:31 查看详情 -

重庆林肯Z现金优惠1.2万元 成都丰田锐志购车优惠2.4万元

2025-11-03 22:23:31 查看详情 -

成都丰田亚洲狮现金优惠3万元 成都丰田锐志购车优惠2.4万元

2025-11-03 22:23:31 查看详情 -

珠海大众宝来现金优惠2.7万 外观流畅

2025-11-03 22:23:31 查看详情 -

成都标致307两厢优惠5千元 长沙现代悦动现金优惠1.2万

2025-11-03 22:23:31 查看详情 -

大连沃尔沃S90现金优惠7.2万 购S80送全购置税加全险

2025-11-03 22:23:31 查看详情 -

长城金刚炮AT车型将于3月2日上市 6.89万

2025-11-03 22:23:31 查看详情

求购

求购